There’s no charge for this.

This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

[vc_row][vc_column width="1/1"][vc_column_text]In 2017, the cryptocurrency phenomenon gripped the world. And even now in 2018, it’s hard to avoid hearing friends, co-workers, or even barbers discussing the purchase of various cryptocurrencies.

This is not a suitable strategy for everyone. Perhaps you’ve not traded cryptos before, and are unwilling to. But that doesn’t mean you’re not curious and attracted by potential returns. Therefore, you’re looking for a safer way to gain exposure to the boom without directly investing in a volatile currency.

This report analyses a handful of blue-chip equities from various sectors which, in their own way, provide exposure to the financial world’s hottest market.[/vc_column_text][vc_column_text]

Since mid-2017, a growing number of media outlets, financial institutions and market commentators have been reporting on the cryptocurrency boom, initially championed by industry flag bearer Bitcoin.

Stories of investors making returns of 100% or more, without any trading experience, attracted immense interest in new but volatile market, especially given low interest rates and overvalued equity markets.

Some traditional investors are cautious, suggesting that price surges are speculative rather than generated by fundamentals. Despite this, demand has boomed globally and shows no sign of letting up, encouraging traditional investors to look elsewhere.

The platforms used to trade them, the computer hardware needed to procure them and research projects to harness their underlying technologies, have all unearthed potential opportunities that do not involve trading the cryptocurrencies themselves.[/vc_column_text][vc_column_text]

There are multiple reasons why direct investment in cryptocurrencies is risky. Primarily, volatility is a concern; swings of 20-30% a day are commonplace and often occur based on very little news. Falling on the wrong side of this could be very costly.

Increased volatility has also lead brokers to double, triple or even quadruple margin required to open even the smallest of positions. The spreads offered by providers are not consistent and often range from 20 to 200 points, meaning you’re often down a considerable amount as soon as you open a position.

And that’s before selecting a cryptocurrency from the array available and confirming with your broker that a trade be made. Many firms have halted or even cut their crypto offerings, leaving investors questioning when, if at all, they can enter a new position.[/vc_column_text][vc_column_text]

These risks are not to be taken lightly, and should you not want to be exposed to them, there are opportunities to trade less volatile equity stocks that have some form of exposure to cryptocurrencies.

This still allows you to tap into the return potential of the cryptocurrency market, however it removes a significant portion of trading risk. Furthermore, the process to trade equities is far simpler than cryptos, through a single, simple platform to execute trades. Furthermore, Accendo Markets is fully regulated by the FCA, protecting you and your money. Contact us to find out more about our award-winning service.[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

NVIDIA (US: NDVA) is a name more familiar to gamers than traders, selling computer chips – Graphic Processing Units or GPUs – to improve the system’s gaming performance. With a new boom, however, comes a new use.

Cryptocurrency miners – most notably in Bitcoin – have assembled vast computing systems that allow them to run the countless millions of calculations needed to mine a Bitcoin, maximising the potential to harvest one. As the number of calculations needed grows exponentially, so does the need for the chips enabling the process. Furthermore, there may be room for demand to grow. As other cryptocurrencies like Ethereum and Ripple gain further prominence, crypto mining has continued its meteoric rise. How much more demand could there be?[/vc_column_text][vc_column_text]

To trade a cryptocurrency, you will need access to a form of wallet and a platform to trade the currencies. As investors experiment with the vast range of offerings available, the most successful and accessible have outperformed rivals. Of publicly-traded companies offering cash platforms, Square (US: SQ) is most intriguing.

The company, the second founded by Twitter CEO Jack Dorsey, saw shares rally 155% in 2017, accelerating later in the year after announcing that clients would be able to purchase Bitcoin on the company’s cash app. The company prides itself on being a disrupter and an early adopter of new technologies, and whilst the current Bitcoin offering is just a trial, it leaves Square with potential to grow into a much larger role within cryptocurrency transactions. This potential has placed it on the radar of those looking for crypto exposure.[/vc_column_text][vc_column_text]

It will come as no surprise to many that Goldman Sachs (US: GS) has been one of the first major global financial institutions to set up a cryptocurrency trading desk. The investment bank, which prides itself on forward thinking, is looking to seize upon the cryptocurrency boom to offset weaker trading in traditional markets.

Goldman’s move to create a cryptocurrency trading desk – reportedly starting trading by end-June, is seen as the embodiment of growing institutional acceptance of the fledgling market, and could be mirrored by its peers.[/vc_column_text][vc_column_text]

While Goldman Sachs may be trading cryptocurrencies, other banks are taking an entirely different approach.

A consortium of major institutions, including the UK’s Barclays (UK: BARC), has begun trialling how crypto technology can be used to guide institutions through the vast MiFID II financial regulations that have come into force in 2018. Alongside UBS, Credit Suisse and Reuters, Barclays is investigating how Ethereum smart contracts can improve data quality and simplify processes. Will the study result in further exploration into crypto tech?[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: RBC Capital Markets, Outperform, Target $250, +17% (3 Jan)

Average Target: $223.4, +4.6% (4 Jan)

Bearish: Wells Fargo, Underperform, Target $87, -59% (17 Nov 17)

Pricing data sourced from Bloomberg on 4 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

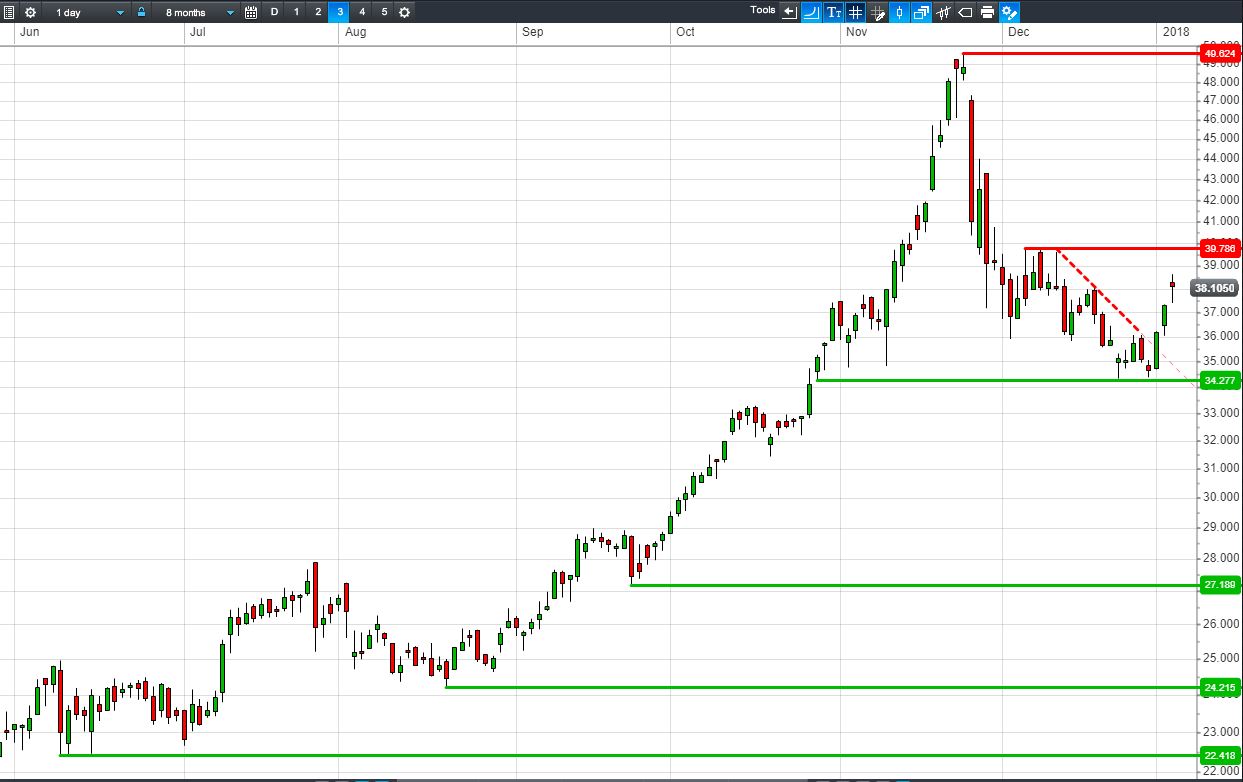

Bullish: Evercore ISI, Outperform, Target $51, +34% (16 Nov 17)

Average Target: $40.36, +5.9% (4 Jan)

Bearish: BTIG, Sell, Target $30, -21% (27 Nov 17)

Pricing data sourced from Bloomberg on 4 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: Barclays, Equalweight, Target $308, +20% (2 Jan)

Average Target: $265.13, +3.2% (4 Jan)

Bearish: Societe Generale, Sell, Target $198, -23% (19 Oct 17)

Pricing data sourced from Bloomberg on 4 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: AlphaValue, Overweight, Target 269p, +33% (1 Jan)

Average Target: 206.2p, +1.7% (4 Jan)

Bearish: Day by Day, Sell, Target 142.4p, -30% (15 Nov 17)

Pricing data sourced from Bloomberg on 4 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

Whether you see UK Stocks going up or down for the remainder of the year, tradable opportunities will present themselves regularly. We’re here to help you weed them out and capitalise on them. Accendo Markets can help you increase your profit potential with the use of leveraged instruments such as CFDs, a flexible alternative to traditional shares that is currently exempt from UK stamp duty.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/2"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/2"][vc_column_text]

While buying 14,182 shares in Lloyds Banking @ 70.51p requires an outlay of around £10,000 plus commission, the same exposure via a CFD requires about £500 plus commission (see right-hand box; margin + costs). If a trader invests in Lloyds Banking, one would assume they believe the share price is likely to move in their favour. After considering the ‘worst case scenario’ and assigning funds to cover it, the trader may conclude there’s little point in exposing the full £10,000 to Lloyds Banking shares - some of that capital could be put to good use elsewhere in the markets. (Source: CMC, Prices indicative)

If you had, say, £10,000 to invest in the stock market, you could deposit that amount into a share dealing account and purchase shares in a company. You would pay commission to open the position, 0.5% in stamp duty and the full £10,000 will be tied up in your chosen shares with any profit or loss based on that exposure. The same £10,000 worth of exposure can be secured with a CFD for a fraction of the initial outlay thanks to leverage, with the risk and reward the same as if £10,000 worth of traditional shares were held. But should you not be interested in leverage, you can always treat CFDs like shares. Simply deposit £10,000 into a CFD trading account and take the equivalent CFD position which will tie up as little as 3%/£300 (note that overnight financing costs will still apply). The remaining £9,700 is not tied up, so you can use some of that to take advantage of another short-term opportunity elsewhere, or simply leave it on the account to support any losses. Best of all, using a CFD means you pay no stamp duty![/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/1"][vc_column_text]

Think shares will rise? Take a long position by buying CFDs (buy low, aiming to sell high). Think they’ll fall? Take a short position by selling CFDs (sell high, aiming to buy low). For a more detailed rundown of CFDs, their mechanics, associated costs and some trading scenarios download our ‘Comprehensive Guide to CFDs’ here.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

Does your current broker’s morning report tell you all you need to know about yesterday’s news? If so, how is it offering you anything more than the plethora of information already available on the internet?

We’re proud that our morning editorial has become a hot commodity in the City, its content quoted daily by the journalists that are writing the news everyone else will be reading later in the day, if not the next. Our morning report tells you what’s driving the market at that moment and what to look out for in the day ahead.

If a company has reported earnings before the market opens, we’ll tell you why the shares are called to open up or down in relation to that announcement.

As well as the Morning Report, signing-up to Accendo Markets Research & Trade Ideas offers you the chance to receive the following publications:

To ensure you can act as quickly as possible, you’ll receive an email with a link to the latest publication as soon as it’s released. You can unsubscribe from these emails at any time.

Based on a wealth of experience, gained from both large and small institutions, our Research and Trade Ideas are produced in-house. Our team of dedicated professionals comprises both analysts and traders, drawing upon a wide range of resources and methodologies.

Our aim is to provide you with the manpower and expertise you need to help you clarify, interpret and capitalise on the ever-growing volume of market information.

The journalists don’t pay for it and neither do you, so why not give it a go? You’ve nothing to lose and perhaps a little more to gain… Subscribe Today!

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/1"][vc_column_text]

Do you need to exchange currency? You could be being overcharged by thousands of pounds by your bank or bureau de change!

It’s now easier than ever to get bank-beating currency exchange rates that could save you thousands. For too long banks have dominated the FX market to the point where they will simply give you an exchange rate that may as well have been plucked from thin air. The current system is due an overhaul.

The foreign exchange market is always moving. On this premise, a new breed of Currency Exchange specialists is able to offer unparalleled services that will help you by constantly monitoring the market on your behalf. It’s now the norm for customers to expect the support of a knowledgeable and approachable account manager - your eyes and ears in the market - who’s always on hand to talk.

Download your free Currency Exchange Guide here to make sure you don’t make the mistake of accepting an inferior exchange rate.

This free guide will tell you:

Whether you're an individual or a business, this guide could put thousands of pounds in your pocket. Be informed, don't lose out. Download your free guide here.

AccendoFX Ltd - 1 Alie Street, London, E1 8DE (UK) - AccendoFX Ltd. is registered with the Financial Conduct Authority (FCA) No. 671133 and HMRC No. 12798406. Registered in England and Wales No. 9269365.[/vc_column_text][/vc_column][/vc_row]

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research