There’s no charge for this.

This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

[vc_row][vc_column width="1/1"][vc_column_text]It can be frustrating having to follow foreign exchange rate movements when you’re changing up your money, whether for business or for pleasure.

What if there was an easier way, where you can instead rely on a trusted brokerage to undertake the time-consuming task of monitoring prices? Even better, what if you could guarantee a fixed price that would remain in place for up to a year?

This is just one example of the services that Accendo FX can provide for you. This report contains further details of how forward contracts can benefit you, as well as other ways to avoid currency risk.[/vc_column_text][vc_column_text]

When you rely on currency exchange, not knowing the daily value of your expenses can be stressful, to say the least.

Why take the added risk of paying your business’ invoices or transferring money abroad at the going market rate, whether attractive or not, when instead you can enjoy the security of Forward Contracts.

Instead of a spot rate, where the current market price is paid for a currency transaction, regardless of future movements, a forward contract guarantees the trade price is held over a given period at a specific value.

For some currencies, this can last up to 12 months and crucially, the price of the forward will not change during the year irrespective of market movements.[/vc_column_text][vc_column_text]

Forward contracts can be agreed with your Accendo FX broker and guaranteed with a deposit of up to 5% of the trade’s value. This is then attributed to the final settlement when funds are required.

The only obligation of a forward contract is that the trade is settled by the agreed date, regardless of the subsequent market movements.[/vc_column_text][vc_column_text]

In recent times, perhaps the best possible example of how a forward contract may benefit you is Brexit.

The surprise result of the EU referendum saw Pound Sterling fall sharply against both the Euro and the US dollar. Should you have used a forward, you may have managed to escape the increased costs.

For example, using a forward contract a trader would have been able to book a specific value of Euros before the referendum at roughly €1.30 per £1.

Subsequently, despite sharp Sterling devaluation, you could have accessed the forward trade at the agreed value at any point over the predetermined time frame, potentially saving you thousands.

Do note, however, should FX markets move in your favour during that period, you are still obligated to complete the forward contract.[/vc_column_text][vc_column_text]

A common strategy when undertaking a large transaction is to book a select percentage of the trade’s cost using a forward, leave the remaining total to a series of spot trades or even further forward trades should the price move in your favour; doing this effectively raises your average price.

Working with Accendo FX, you can navigate the risks FX markets can throw at an individual or business.

Our talented team will help you to secure forward contracts to help alleviate the risks of FX dealing, and will also provide you with crucial information about pivotal events for your chosen currency pairing.[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

The dollar is in decline. The global reserve currency had a torrid 2017, and that trend has continued into 2018. Having initially rallied after the election of President Trump, since his January 2017 inauguration the dollar has fallen consistently. Even the first major overhaul to the US tax system in 30 years has done little to aid sentiment.

This has subsequently impacted both Sterling and the Euro. The former traded a post-Brexit high above $1.39 within the first three weeks of 2018, while the latter climbed to a 3-year high above €1.23 against the greenback.

But what could help plug the dollar leak? In the early part of the year, traders will be carefully watching both the European Central Bank and the US Federal Reserve as both institutions make drastic in-house changes.

The former has begun tapering its vast Quantitative Easing (QE) scheme in 2018, a process which will eventually see asset purchases fall to zero. Just how fast President Draghi and the rest of the Governing Council decide to taper purchases will be key to the Euro’s performance over the course of the year. With the current tapering deal running until September, expect an announcement in the preceding months and potentially as early as March.

Meanwhile, the US Fed will have a new face at the helm. Outgoing Chair Janet Yellen will be replaced by Governor Jerome ‘Jay’ Powell, a former investment banker nominated to the top job by President Trump. Many on the outside believe that Powell will be more hawkish than his predecessor, accelerating the rate at which the Fed will hike rates. But as a conforming member of the FOMC since beginning his governorship during the Obama administration, will Powell instead follow his former boss in committing to a steady pace of hikes?

Last, but certainly not least, Brexit negotiations between the UK and EU will reach full throttle in 2018, and are expected to reach a critical venture in Autumn. Chief EU negotiator Michel Barnier has suggested a transition agreement could be reached by October. But with a colossal amount of legal complexities needing to be resolved, can a deal be hammered out in time? Or might delays put Britain’s EU exit in a precarious position?[/vc_column_text][vc_column_text]

As mentioned earlier, forward contracts can act as protection when FX markets move against your positions.

In a hypothetical example, if an individual wanted to exchange $100,000 into Sterling after selling their US home, but GBP/USD (Cable) rallies to 2016 highs of $1.50 by the end of 2018, securing a forward contract at $1.35 could save the individual £7,400. Forwards also work should your currency pairing be subject to a sharp devaluation.

For example, a business needs to exchange £100,000 into Euros to buy goods, but GBP/EUR falls to €1.05 (2017 lows) by the end of the year, securing a forward contract at a rate of €1.13 now could save the business £6,000.

Remember, in both examples, if the market moves in your favour you are still obliged to pay the agreed forward contract rate by the agreed date, regardless of the rate.

[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: ING Financial Markets, Target $1.53, +10.4%, (7 Dec 17)

Average Target: $1.35, -4.1% (18 Jan 18)

Bearish: RBC Capital Markets, Target $1.20, -13.4% (18 Dec 17)

Pricing and consensus data sourced from Bloomberg on 18 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

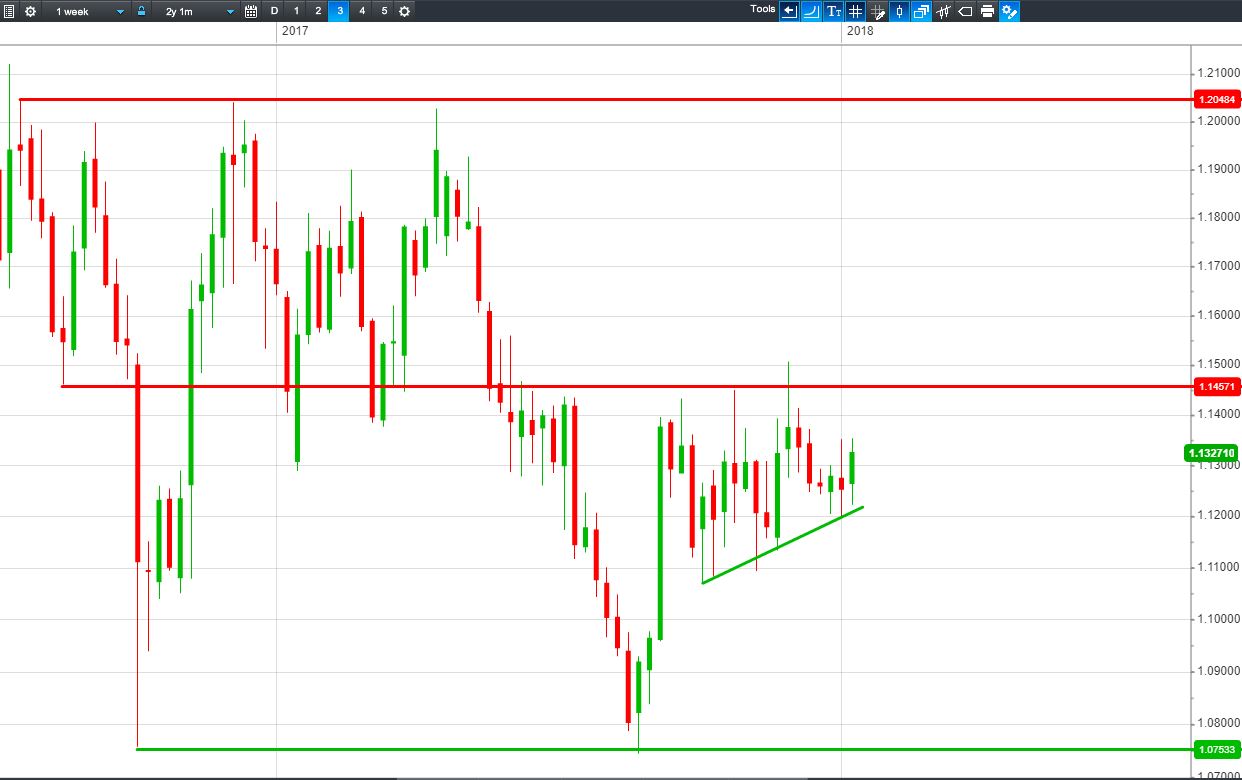

Bullish: Barclays, Target €1.176, +3.8% (5 Jan 18)

Average Target: €1.10, -2.9% (18 Jan 18)

Bearish: Societe Generale, Target €1.02, -10% (3 Oct 17)

Pricing and consensus data sourced from Bloomberg on 18 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: Nomura, Target $1.35, +10.4%, (24 Nov 17)

Average Target: $1.22, -2.9% (18 Jan 18)

Bearish: Commerzbank, Target $1.12, -8.5% (12 Jan 18)

Pricing and consensus data sourced from Bloomberg on 18 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/1"][vc_column_text]

Do you need to exchange currency? You could be being overcharged by thousands of pounds by your bank or bureau de change!

It’s now easier than ever to get bank-beating currency exchange rates that could save you thousands. For too long banks have dominated the FX market to the point where they will simply give you an exchange rate that may as well have been plucked from thin air. The current system is due an overhaul.

The foreign exchange market is always moving. On this premise, a new breed of Currency Exchange specialists is able to offer unparalleled services that will help you by constantly monitoring the market on your behalf. It’s now the norm for customers to expect the support of a knowledgeable and approachable account manager - your eyes and ears in the market - who’s always on hand to talk.

Quite simply, you can get commission free currency exchange at bank-beating rates and free onward transfer to your destination of choice.

Sound too good to be true? To find out how you can get better currency exchange rates and a better service for less register with Accendo FX today.

Free to open

Bank-beating exchange rates

No transfer fees

Dedicated currency trader to assist you

Expert research and guidance

AccendoFX Ltd - 1 Alie Street, London, E1 8DE (UK) - AccendoFX Ltd. is registered with the Financial Conduct Authority (FCA) No. 671133 and HMRC No. 12798406. Registered in England and Wales No. 9269365.[/vc_column_text][/vc_column][/vc_row]

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research