There’s no charge for this.

This report is not a personal recommendation and does not take into account your personal circumstances or appetite for risk.

[vc_row][vc_column width="1/1"][vc_column_text]10 years on from the financial crisis, Banks are back with a bang. With a global share price rally of just under 20% in 2017 according to MSCI, global banks have come a long way from the dark days of 2008.

Following tales of brash bankers’ bonuses, and never being far from a new scandal, a lot has been done to turn around their reputations in the post-crisis world.

But will 2018 finally see their shackles cast off by the Trump administration, while central bankers reign in their purse strings after years of generous spending?

This report explores ongoing themes that will move the UK banking sector, and also looks into what we can expect from each of the big four banks in 2018.[/vc_column_text][vc_column_text]

The post-crisis period has been defined by the immediate action of central banks to stem financial concerns. A key provision, enacted by monetary policymakers from Europe to Japan, was Quantitative Easing (QE) – the purchase of public and private debt by central banks, while simultaneously reducing interest rates to their lowest ever levels.

10 years on, only the Federal Reserve has ended its QE programme and started raising interest rates, while the European Central Bank (ECB) began tapering its asset purchases at the tail end of 2017 and the Bank of England continues its vast QE cycle.

But 2017 did show the tide may be turning. On top of hiking interest rates, the Fed is ending reinvestment of its QE profits, while the ECB may look to extend its taper later in the year. And although the BoE hasn’t made an announcement on a sustained hiking cycle yet, 2017 saw its first interest rate hike in 10 years.[/vc_column_text][vc_column_text]

Not everything went in favour of President Trump during his first year. But after months of cracking heads, his administration finally achieved a legislative victory – the first US tax reform in 30 years.

Cutting the main corporation tax rate to 20% from around 35%, one of the world’s highest, has resulted in a number of both US-based and US-exposed firms announcing a one-off hit to Q4 profits, however the reform is also expected to raise future earnings.

How these banks manage the new legislation going forward, through reinvestment, dividends or share buybacks, will be the key to 2018 performance.[/vc_column_text][vc_column_text]

With tax reform marking a major moment not just for Trump, but also for Republicans, the administration hopes the average worker will benefit enough to secure a victory in mid-term elections in November.

However, what Trump does next will also be key. There are multiple ideas of what the President will decide, although widespread sector deregulation seems to be the Republican’s preferred dish.

Whether that will extend to a vast repeal of the Obama era Dodd-Frank regulations – including the Volcker rule which bans internal proprietary trading – remains to be seen. However, with trading profits falling at investment banks across the world, many could look favourably on such a decision to repeal.[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

The most US-exposed of the UK Banks, Barclays could stand to be the greatest benefactor of President Trump’s next policy focus. A deregulation-happy administration that sets its sights on Obama era legislation – including the Volcker rule, a law unpopular with Wall Street that bans in-house proprietary trading – could result in a fresh wave of optimism in the States and even the re-establishment of those outlawed trading desks.

Closer to home, how the Bank of England responds to rising inflation, and ongoing Brexit talks – including a potential bespoke deal for the financial sector – will be key factors as to how the cross-border bank fares in 2018.[/vc_column_text][vc_column_text]

The other internationally-exposed UK Bank, HSBC (HSBA), also looks set to benefit from the US tax reform which, although potentially leading to a one-off profit hit in Q4, could lower the global bank’s total tax bill.

But, as the largest UK bank, HSBC will also be closely watching Brexit negotiations. Headquartered in London, the bank currently has unfettered access to UK and European markets. If, however, no deal to allow UK financial services to access the European mainland is reached, it could force the bank to move. Tack on a heavy reliance on Asian markets such as Hong Kong, and HSBC will be the institution most influenced by global events in 2018.[/vc_column_text][vc_column_text]

The bailed-out banks turned retail investor darling, Lloyds (LLOY) remains a key barometer of the UK economy as the holder of its largest mortgage book. Under Chancellor Hammond’s leadership, the Treasury has sold the entirety of its 43% post-bailout position. Now, the bank looks to return to its heady pre-2008 300p highs.

How can it achieve that? Further hawkishness from the bank of England would be needed in 2017, having raised interest for the first time in a decade in 2017. Whilst policymakers have forecast a further two rate hikes over the coming three years, any indication that high inflation will persist may force them to act sooner, rather than later.

[/vc_column_text][vc_column_text]

As the only major UK Bank to be bailed out by the taxpayer that remains in the Government’s hands, the Royal Bank of Scotland (RBS) has been forced to all but retreat from its operations that once spanned the globe. That, however, could be seen as a bonus for those traders looking for isolation from the US – in particular the man leading administration and his propensity to act on a whim. Might 2018 be the year to stay away from the US?

The bank has done a lot to clean up its act, settling several legacy court cases. With that said, the big one is still outstanding; despite settling fraud claims with the US Department of Justice, RBS is still faces a multi-billion dollar fine for selling mortgage backed securities before the 2008 crisis. Will a figure finally be reached this year?[/vc_column_text][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: AlphaValue, Buy, Target 274p, +41% (11 Jan)

Average Target: 207.2p, +6.3% (11 Jan)

Bearish: Day by Day, Sell, Target 142.4p, -27% (15 Nov 17)

Pricing data sourced from Bloomberg on 11 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

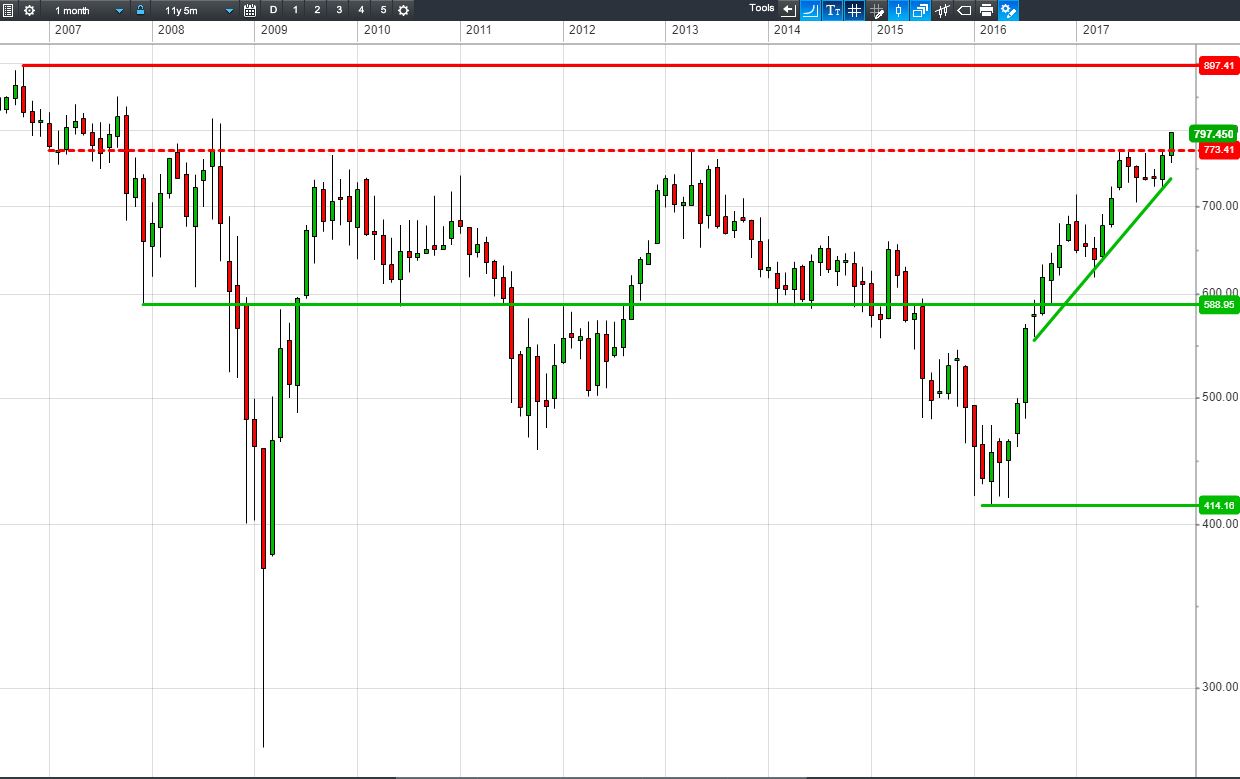

Bullish: Jefferies, Buy, Target 920p, +15% (7 Dec 17)

Average Target: 767.6p, -3.7% (11 Jan)

Bearish: Grupo Santander, Underweight, Target 442p, -45% (2 Oct 17)

Pricing data sourced from Bloomberg on 11 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: Jefferies, Buy, Target 91p, +30% (29 Nov 17)

Average Target: 72.3p, +3.4% (11 Jan)

Bearish: Goldman Sachs, Sell, Target 53p, -24% (5 Dec 17)

Pricing data sourced from Bloomberg on 11 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][vc_column_text]

[/vc_column_text][vc_column_text]

Bullish: Grupo Santander, Buy, Target 346p, +17% (2 Oct 17)

Average Target: 287.3p, -3.2% (11 Jan)

Bearish: Mediobanca, Underperform, Target 244p, -17.8% (21 Nov 17)

Pricing data sourced from Bloomberg on 11 January. Please contact us for a full, up to date rundown.[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

Whether you see UK Stocks going up or down for the remainder of the year, tradable opportunities will present themselves regularly. We’re here to help you weed them out and capitalise on them. Accendo Markets can help you increase your profit potential with the use of leveraged instruments such as CFDs, a flexible alternative to traditional shares that is currently exempt from UK stamp duty.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/2"][vc_column_text]

[/vc_column_text][/vc_column][vc_column width="1/2"][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/1"][vc_column_text]

The example above shows how buying 1,450 shares in British Land @ £6.90 requires an outlay of around £10,000 plus commission (see left-hand box), while the same exposure via a CFD requires about £500 plus commission (see right-hand box). If a trader invests in British Land, one would assume they believe the share price is likely to move in their favour. After considering the ‘worst case scenario’ and assigning funds to cover it, the trader may conclude there’s little point in exposing the full £10,000 to the BLND shares - some of that capital could be put to good use elsewhere in the markets. (Source: IG, Prices indicative)

If you had, say, £10,000 to invest in the stock market, you could deposit that amount into a share dealing account and purchase shares in a company. You would pay commission to open the position, 0.5% in stamp duty and the full £10,000 will be tied up in your chosen shares with any profit or loss based on that exposure. The same £10,000 worth of exposure can be secured with a CFD for a fraction of the initial outlay thanks to leverage, with the risk and reward the same as if £10,000 worth of traditional shares were held. But should you not be interested in leverage, you can always treat CFDs like shares. Simply deposit £10,000 into a CFD trading account and take the equivalent CFD position which will tie up just £500 (note that overnight financing costs will still apply). The remaining £9,500 is not tied up, so you can use some of that to take advantage of another short-term opportunity elsewhere, or simply leave it on the account to support any losses. Best of all, using a CFD means you pay no stamp duty!

Think shares will rise? Take a long position by buying CFDs (buy low, aiming to sell high). Think they’ll fall? Take a short position by selling CFDs (sell high, aiming to buy low). For a more detailed rundown of CFDs, their mechanics, associated costs and some trading scenarios download our ‘Comprehensive Guide to CFDs’ here.

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

Does your current broker’s morning report tell you all you need to know about yesterday’s news? If so, how is it offering you anything more than the plethora of information already available on the internet?

We’re proud that our morning editorial has become a hot commodity in the City, its content quoted daily by the journalists that are writing the news everyone else will be reading later in the day, if not the next. Our morning report tells you what’s driving the market at that moment and what to look out for in the day ahead.

If a company has reported earnings before the market opens, we’ll tell you why the shares are called to open up or down in relation to that announcement.

As well as the Morning Report, signing-up to Accendo Markets Research & Trade Ideas offers you the chance to receive the following publications:

To ensure you can act as quickly as possible, you’ll receive an email with a link to the latest publication as soon as it’s released. You can unsubscribe from these emails at any time.

Based on a wealth of experience, gained from both large and small institutions, our Research and Trade Ideas are produced in-house. Our team of dedicated professionals comprises both analysts and traders, drawing upon a wide range of resources and methodologies.

Our aim is to provide you with the manpower and expertise you need to help you clarify, interpret and capitalise on the ever-growing volume of market information.

The journalists don’t pay for it and neither do you, so why not give it a go? You’ve nothing to lose and perhaps a little more to gain… Subscribe Today!

[/vc_column_text][/vc_column][/vc_row]

[vc_row][vc_column width="1/1"][vc_column_text]

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width="1/1"][vc_column_text]

Do you need to exchange currency? You could be being overcharged by thousands of pounds by your bank or bureau de change!

It’s now easier than ever to get bank-beating currency exchange rates that could save you thousands. For too long banks have dominated the FX market to the point where they will simply give you an exchange rate that may as well have been plucked from thin air. The current system is due an overhaul.

The foreign exchange market is always moving. On this premise, a new breed of Currency Exchange specialists is able to offer unparalleled services that will help you by constantly monitoring the market on your behalf. It’s now the norm for customers to expect the support of a knowledgeable and approachable account manager - your eyes and ears in the market - who’s always on hand to talk.

Download your free Currency Exchange Guide here to make sure you don’t make the mistake of accepting an inferior exchange rate.

This free guide will tell you:

Whether you're an individual or a business, this guide could put thousands of pounds in your pocket. Be informed, don't lose out. Download your free guide here.

AccendoFX Ltd - 1 Alie Street, London, E1 8DE (UK) - AccendoFX Ltd. is registered with the Financial Conduct Authority (FCA) No. 671133 and HMRC No. 12798406. Registered in England and Wales No. 9269365.[/vc_column_text][/vc_column][/vc_row]

This research is produced by Accendo Markets Limited. Research produced and disseminated by Accendo Markets is classified as non-independent research, and is therefore a marketing communication. This investment research has not been prepared in accordance with legal requirements designed to promote its independence and it is not subject to the prohibition on dealing ahead of the dissemination of investment research. This research does not constitute a personal recommendation or offer to enter into a transaction or an investment, and is produced and distributed for information purposes only.

Accendo Markets considers opinions and information contained within the research to be valid when published, and gives no warranty as to the investments referred to in this material. The income from the investments referred to may go down as well as up, and investors may realise losses on investments. The past performance of a particular investment is not necessarily a guide to its future performance. Prepared by Michael van Dulken, Head of Research